The value chain is one of the most powerful strategic tools. Michael Porter (the originator of the value chain concept) uses this tool to define what strategy is. However, the work of Porter looks more focused on strategy formulation than on strategy execution. There is a gap between understanding the concept of the value chain and implement it. So, let’s go to analyze how to implement in 10 steps the value chain tool successfully.

Infographic adapted from SCOR Process Framework (Supply Chain Council): How to Implement the Value Chain

The 10 steps of value chain

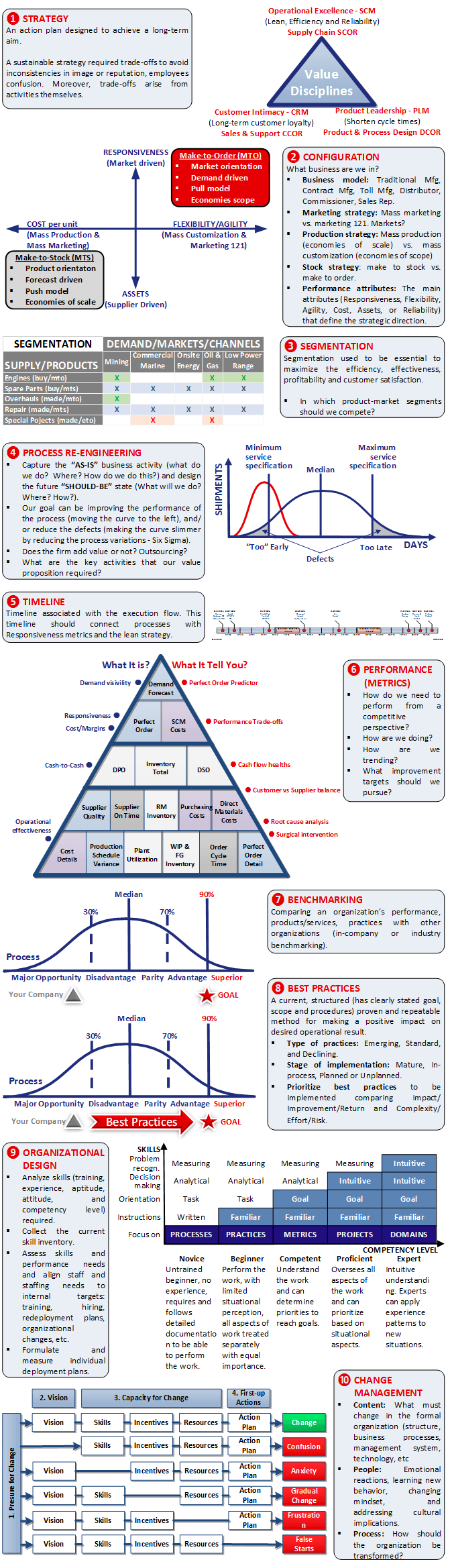

The first step is defining the Business Strategy of the firm. I mean defining our main Value Discipline (Operational Excellence, Customer Intimacy or Product Leadership according to Michael Treacy and Fred Wiersema) or our Core Business (Infrastructure Management, Customer Relationship Management or Product Innovation according to John Hagel III and Marc Singer). Be aware that both are quite similar strategic frameworks to define our strategy. The good point of these approaches to strategy is that those are probably more specific than Porter Generic Strategies (Cost Leadership, Differentiation, and Focus). This is important because the Value Discipline and Core Business frameworks make a better fit between strategy and processes/activities. Processes/activities are the key element for implementation.

In 1996, Porter in his famous HBR article “What Is Strategy?” declared that Operational Effectiveness is not a strategy. He explained that Japanese companies rarely have strategies and those were based on Operational Effectiveness in the 1980s. He suggested that competitors could quickly imitate best practices, management techniques, and so on. However, after two decades from the publication of the article the reality is other. Japanese companies (Toyota, Honda, Bridgestone, Canon, Ricoh, Seiko, Sony, Panasonic, Nikon, Yamaha, etc.) still enjoy of an important Sustainable Competitive Advantage. So, according to the facts we should consider that Operational Excellence is a working strategy.

Some of the Operational Effectiveness tools (benchmarking, best practices, performance management, change management, and so on) are helping us to implement the concept of the value chain despite the Value Discipline chosen.

The second step could be called Configuration. Now, we are aligning the Value Discipline chosen with some of the main functional strategies (Business Model, Marketing, Production, Logistics/Stock, and Performance). This step helps us to define our business strategy deeper in order to have an actionable strategy.

Many firms used to fail in the strategy execution rather than in the strategy formulation process. Failed strategies that demand a turnaround used to involve re-focusing on target industries, product, markets or activities of the value chain. So, the configuration step is one of the most important steps analyzing the value chain. Usually a BCG Matrix or other strategic portfolio tools should be used to get a deeper inside.

The third step is Segmentation. There is a common mistake that is “trying to be everything to all customers.” This used to mean that we are not able to excel in any particular segment because we lose focus. Without the correct focus (segmentation), the value chain implementation will have a high risk of failing.

Then the fourth step should be Process Reengineering. There are a few common mistakes that make firms fail in performing re-engineering:

- Limit the concept of process re-engineering to improve current activities (tactical level): Why do not you use re-engineering to perform different activities? (Strategic level as Porter suggests.) We can use re-engineering at tactical level, strategic level or both. The strategic level should have higher organizational impact. Are you measuring how many of your reengineering initiatives belong to tactical and strategic level?

- Lack strategic thinking on the value chain: Focusing too much in operational processes and neglecting the strategic activities. We should wonder ourselves: what are the key activities that our value proposition is requiring?

- Fail to see the potential of outsourcing: Some people could be afraid of outsourcing because outsourcing could be interpreted as we are not able to improve those processes or activities internally. Indeed, it is very difficult to compete with specialized firms which offer outsourcing services. Therefore, it is a worthy solution to use outsourcing firms in order to leverage us on their Competitive Advantages. Outsourcing is a tool that can bring massive value to our firm (focus, expertise, reduce complexity, flexibility, savings, and cash-flow improvements.)

- Reduce re-engineering tools to process mapping and the ISO norm: Modern re-engineering processes cannot be understood without using analytical and improving techniques like Lean and Six Sigma. Furthermore, other complementary management tools are needed like performance management, best practices, project management, or change management.

- Substitute process knowledge for common sense: Inexperienced reengineering people are not likely able to detect problems, make a diagnostic, and fix the problem quickly. So, their job is based mainly on interviewing users and asking them for solutions. The value that they add is “using common sense” to the input received from the business users. Common sense is necessary, but it is not enough to generate a Competitive Advantage. Highly effective re-engineering required of a deep knowledge of the best class processes (supply chain process, sales process, etc.)

- Reinventing the wheel in process re-engineering: There are a few well-developed process frameworks from prestigious organizations (APICS Supply Chain Council – SCC, American Productivity & Quality Center – APQC or Value Chain Group – VCG). However, there are people who do not follow any proven process framework. In those cases they are probably reengineering based on common sense what will take too much time, cost and the result would be poorly compared with competitors using those frameworks.

- Assume that organizations need a specialized process re-engineering team to lead re-engineering rather than support it: I think that is more powerful having the owners of the processes leading and performing the re-engineering tasks. When the re-engineering come from users used to bring more powerful organizational changes and the reengineering is better embedded into the organization. Leading the re-engineering process from inside the areas (supply chain, customer relationship, human resources, etc.) is an indicator of the firm maturity and the quality on the staff. For this approach, organizations need a re-engineering team that train users and offer support rather than decide what must be changed.

Probably the best indicator that we have a solid business strategy and value chain execution is having the capability to replicate successfully strategies in different geographies (e.g. Zara/Inditex or McDonalds). Be aware that replication is quite difficult to achieve without robust and well defined processes.

Fifth step used to be ignoring for many organizations. Timeline is a key element to properly execute activities. Do you think is the same using 5 minutes for machines’ setup times than 5 hours? Do you think is the same unload trucks from 7:00 AM to 12:00 AM than allowing unload any time of the day? Obviously not, so process without timeline means processes not well defined. This will create coordination problems between different areas, friction between people performing sequential activities, problems measuring the important responsiveness KPIs, etc. Probably the most important issue to not defining timelines is that we would be unable to implement the “sense of urgency” in our organization. I mean urgency to satisfy customers’ needs, urgency to invoice customers on time, urgency to receive customers’ payments that improve our cash flow, and so on.

The next step is the sixth, Performance Management (Metrics). Nowadays, it is well known what it is a Key Performance Indicator (KPI). Nonetheless, many firms are not able to answer the following questions:

- What are the strategic attributes of the company?

- What are the overall health, diagnostic and root cause KPIs for any strategic attribute?

- How many KPIs should we have?

- What KPIs should we measure?

The answer of those questions is important in order to be sure that we have in place the correct KPIs to monitor our value chain. We should remember that “what it is not measured, it is not improved it.”

Once that we are able to define our KPIs, the next questions are:

- Where is the information that we need?

- How can we extract that information?

- What are the dashboards or scorecards that we are using to present and communicate properly the KPIs?

Seventh step, Benchmarking: This management tool allows us to compare the performance of our main processes or activities with those of other comparable organizations (internal or external). So, this tool is allowing us to prioritize our value chain initiatives according to the higher gap between our current situation and the potential future state (higher potential benefits) and lower implementation risks.

Eighth step, Best Practices: As Michael Porter said: we could argue that the rapid diffusion of best practices means that competitor can quickly copy them. However, thinking in that way we would likely underestimate implementation diversity and complexity. Thus, we would not consider the competency to implement as source of Competitive Advantage. Why is implementation a source of Competitive Advantage? Because the implementation capability is very complex to imitate and used to make a huge difference between firms competing. For instance, if we ask a few chefs to cook a written recipe, with similar conditions (ingredients, oven, etc.), we will likely realize that the result of each chef can be reasonably similar but very different. Imagine the differences in results with the following circumstances that affect defining and executing the company’s value chain:

- Activities: There are more than 1.000 activities (APQC) and like Porter mentioned trade-offs arise from activities themselves.

- Best practices: There are hundreds of best practices, and trade-offs arise from best practices themselves too.

- IT systems: Companies have different IT systems (Google, SAP, Oracle, Microsoft, etc.) with specific customizations what means that not all the best practices can be implemented in all the IT platforms or in the same way.

- People: Each organization has different people with different mindsets and skills. So, the perceptions of which activities are an opportunity or which are risky rely on the teams of each particular firm.

- Culture: Each organization has its specific culture. For instance regarding innovation we have innovators, early adopters, laggards, and so on.

Other advantage of using best practices is that push us to monitor the external environment in which we are following competitors. Additionally, best practices should help us to think out the box and to foster the creation of our own best practices list which could mean performing different activities than our rivals.

When we are talking about strategy execution, the variable people cannot be missed. Thus, the step ninth is Organizational Design where we assess any gap between the current inventory of our skills and the competencies level.

Finally, the step tenth Change Management considers a much broader implementation concept than just people issues. This is the last step for the value chain implementation, but it is not the less important. It is usual to find failed value chain initiatives where the design team is just blaming users because they did not implement properly. It is true that end users are responsible for delivering results too, although it is well known that there are many handicaps to make things happen. Thus, the design team is responsible for having a change management program, and a periodic follow-up that guarantees the success of all the initiatives.