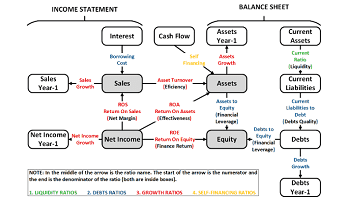

In 1920 DuPont created DuPont Model. Almost one century after DuPont started using this analysis, it still remains a quick and useful tool for analyzing firm’s financial situation and improvements’ status.

The heart of the model is the ROE (Return On Equity) = Profitability x Efficiency x Financial leverage. In this Extended DuPont Model we have added the following features:

- The model has been extended to add essential information to analyze some of the main risks for the survival of the firm (liquidity and indebtedness). Thus, we have added the following ratios: the current ratio (liquidity), current liabilities to debt (debts quality), borrowing cost and self-financing.

- We have added some financial tendency information (present and last year information) of a few main variables: Sales, Net income, Assets and Debts.

Adapted from Oriol Amat: Extended DuPont Model

Extended DuPont Model contributions

- It shows information about the main traditional economic value indicators: Net income, Cash flow, ROA, and ROE.

- The model is based on ratios that can be easily and quickly created extracting the information from the income statement and balance sheet (annual report).

- Those ratios summarize the financial situation of the company and allow us to compare easily our performance with other subsidiaries and even with our competitors or best in class firms in our industry.

- It is a “simple” and quick tool that provides a better understanding of the main accounting variables and how they are related. There are other tools like EVA (Economic Added Value) that approach the value creation issue but they are more complex to implement.

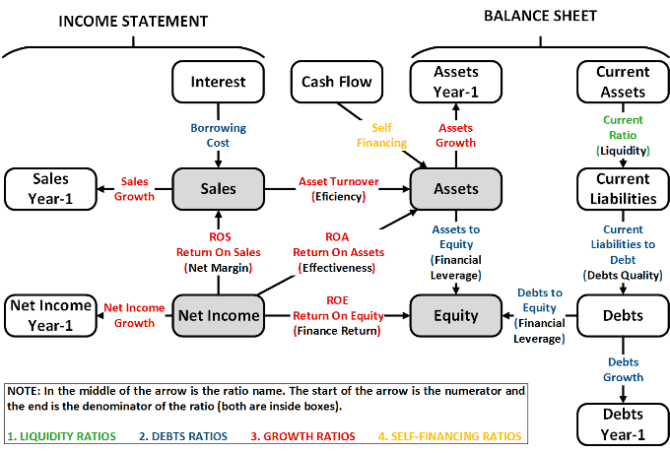

- It brings some important growth conclusions:

Growth model

- High turnover

- High margins

- High turnover and margins

- No growth model at all

Growth status

- Healthy and balanced growth of all model ratios

- So fast growth (indebtedness and ROA problems)

- Run away to the front (just sales are growing, so this growth without profitability is unhealthy and will likely continue deteriorating the indebtedness ratios)

- Sales issue, but the other ratios are not underperforming “yet.”

- Weak growth (sales and ROE problems)

- Excess of structure (the structure is too big and all the ratios are underperforming)